Ontario sportsbook consolidation continues with Unibet exit, casino-only operator numbers to grow

December 11, 2023

The iGaming Ontario market continues to evolve. As companies evaluate where to allocate capital and deploy their brands, we will be seeing fewer legal Ontario sportsbooks. GAN was the first sports betting operator to withdraw from the Ontario market, as "CoolBet" officially exited by the April 3, 2023 deadline. They did not look to renew their license. Kindred Group has been undergoing a strategic review, with activist investors seeking a sale of the company. To date, no interested buyers for Kindred have been found, but as a result of the strategic review, they will be withdrawing their Unibet brand from all regulated North American markets, including a withdrawal from Ontario. This exit is to be complete by the second quarter of 2024.

Both CoolBet and Unibet operate within the Canadian "grey market" of online gambling, from their "offshore" jurisdictions, but with the tax rate component associated with their Ontario operations, and the vast array of competition, these brands found it simply made more sense to focus their efforts in markets where they have more brand strength, and/or can operate with less regulatory constraints. This comes with little surprise here, especially in the case of Kindred, which had difficulty in navigating the rules of the market, and executed poorly from a technical perspective. So why did Kindred and Unibet fail in Ontario? There were several reasons.

The failures of Kindred Group and Unibet in Ontario

Here at SNBET, we have very positive feelings about Kindred as an igaming operator, as they genuinely care about the health of their players, and generally offer a top tier product. However, we had several concerns about their approach in Ontario, and these were shared with the company. First, we actually noticed several "above the line" online ads that were out of compliance with Ontario's ban on inducements. These online ads were outside the affiliate marketing platform, and would have been placed with direct approvals from Kindred representatives. Kindred was fined by the AGCO for these violations.

We also pointed out several technical concerns with the Unibet casino product, which seemed as though it was rushed to market before it was ready. Several of the free-to-play demo games essentially did not work, so anyone looking to give Unibet's slots or casino games a try before signing up would have gotten an ugly error message. Despite being highlighted to the company, these issues were not fixed in a timely manner.

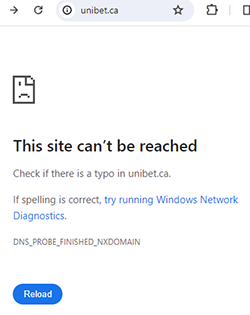

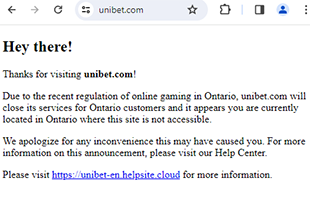

Other aspects or suggestions for improvement of their approach were also dismissed or ignored. For example, if any user in Ontario had heard one of Unibet's casino ads on the radio, and navigated directly to "unibet-dot-ca", the user would get a screen that said "this site can't be reached". The correct URL for Ontario was "on-dot-unibet-dot-ca". Any user that went to the plain "dot-ca" domain should have been forwarded to the correct URL, based on their IP address location, or been provided an option to navigate manually to the correct version. Neither option was in place, so potential customers were stopped in their tracks. Users in Ontario that navigated to "unibet-dot-com", rather than being forwarded to the correct URL or given a way to navigate to the correct site version, were shown a screen that made it look like Unibet was not available in Ontario.

Both of these instances added unnecessary friction to the process of linking their offline marketing to their online product, which could only lead to missing out on adding new players and revenue. With these obstacles, some potential customers will just give up. Others might move to search for a generic casino or sportsbook keyword string, taking the user away from Unibet. Potential customers that persist past these "stop sign" screens with a search for "Unibet" or similar, will be confronted with up to four legal sportsbook or casino brand alternatives within Google ads at the top of the search listings, as competitors look to poach these players, taking them off track. Why allow this to happen when you have people looking to navigate directly to your site?

All successful brands in the Ontario market that also operate in the "rest of Canada" market via offshore jurisdictions, like Unibet, found a way to create frictionless ways to funnel players to their respective applicable platforms. This was a clear failure at Kindred, and one that we had notified them about, but which has been ignored to this day. The screenshots provided, which illustrate these friction points, were still in place as of the day of writing, on December 11, 2023.

Unibet Ontario Technical Failures |

|

|

|

|

Another likely reason for the failure of Unibet within the North American market was their online and onsite marketing campaign using "Nigel", a frizzy-haired, supposedly British character, as their fictional head of sportsbook in North America. When most successful brands were looking to find a way to adapt their brands to what was already a unique but mature, well-established local market, this approach would do little to ingratiate the brand to a Canadian audience.

Furthermore, for us, it wasn't an authentic marketing approach. While Unibet was born in London and has a foothold in the UK market, it was a Swede that founded it, Stockholm is where the company's shares trade, and it is in the Nordic markets where Unibet is most entrenched as a brand. Why were they trying to be "British" in Ontario and the rest of their North American regulated markets? Again, our concerns were communicated to the company, but they were confident in their marketing approach, and referred to "great success" with Nigel in their US campaign so far. It was such an odd choice, and combined with the other failures listed above, the likely poor return on investment surely made the choice to exit the regulated North American market a fairly easy one.

While Ontario sports betting options are fewer, casino-only brands continue to arrive

It had been several months since any new brands or operators had been added to the AGCO registry of licensed operators. This changed on November 29, 2023, when AG Communications became licensed to bring their "Magic Red" casino brand to the iGaming Ontario platform. AG Communications operates several iGaming brands in other jurisdictions, including ones that have a sportsbook vertical in "Karamba" and "MrPlay". It says a lot that they only looked to bring one of their casino-only brands to the Ontario market, and not the ones which include sports betting. Just a couple weeks later, The Six Gaming gained licenses for their second and third casino-only brands, with "Kong Casino" and "Fever Slots" to complement their initial casino-only brand in Ontario, "Amazon Slots".

We expect these trends to continue. Several other brands that include a sportsbook component, appear to be candidates to exit Ontario in the coming months, given the affiliate marketing signals that we see. Operators with several brands in the market seemingly appear ready to consolidate behind one brand rather than several, in order to save on licensing and marketing expenses. Conversely, with iCasino being by far the most lucrative gaming vertical, we expect several more casino-only brands to enter Ontario over the course of 2024.

Back to SNBET's Ontario sports betting news.