iGaming Ontario solicits RFPs for centralized player self-exclusion solution: why it's important, what it might look like & why other provinces should follow

January 9, 2024

The iGaming Ontario market opened on April 4 2022. It did so without a centralized self-exclusion platform for players, but launched with a promise that one would be coming. On its website, iGO announced that they would be requesting proposals to build such a solution:

To support players who decide to stop or take a break from gambling, iGO intends to issue a request for proposals (RFP) in early 2024 for a centralized self-exclusion solution that will enable a player to self-exclude from all Ontario regulated igaming operators in a single registration process.

Why is a central self-exclusion platform important?

A centralized self-exclusion system is crucial for harm reduction within what is now one of the largest regulated online gambling markets in the world, with dozens of branded iGO operations. Why so? When you have over 70 brands operating in a market, do you want individuals with gambling addiction to have to self-exclude separately from each and every one? Of course not. A centralized system means that with one touch-point, players are able to add themselves to a database of self-excluded players, from which every iGO operator must cross-reference as any player looks to login or sign-up, on an ongoing basis.

What should iGaming Ontario's self-exclusion platform look like? Are there examples to follow?

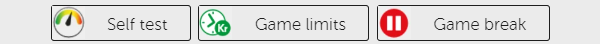

We would argue that Sweden has the best and most effective kind of central self-exclusion system in terms of how easy it is for players to access the three main tools for harm reduction. It is what iGaming Ontario should look to replicate as best possible, given their own KYC limitations in comparison to Sweden (which we'll discuss later). At the top of every page, across all of Sweden's regulated gambling sites, there are three buttons:

1) The "Self test" button opens a browser tab towards an anonymous self test where the player may answer questions to see if they are, or might become at risk of problem gambling. 2) The "Game limits" button allows immediate access to set time and money-related limits that will apply across all providers, not just for the one that the player is accessing. 3) The "Game break" button allows immediate access to self-exclude from all online gambling platforms in Sweden, for a period of the player's choosing, in months. Once an exclusion period has been set, the player can neither play nor reverse the exclusion, until the set period ends.

Can iGO just easily replicate Sweden's self-exclusion?

While Sweden's self-exclusion system is what we think iGO should aspire to replicate in Ontario, there is a reasonably significant hurdle to overcome before this might be achieved. Swedish gaming operators use something called BankID to identify their customers. It is an electronic identification system that is used by over 94% of mobile phone users in that country, which is run by several Swedish banks. BankID numbers can only be issued to users that have a Swedish personal identity number, which in Canada would be akin to our Social Insurance Number, or SIN. No matter what postal addresses or contact methods a person in Sweden might use to register an account, the BankID ensures full and robust association to the self-exclusion database. iGaming Ontario does not have an equivalent identification system in use, which will make it more difficult to correctly and fully cross-reference a database of excluded individuals, without people falling through the cracks.

While Know Your Customer practices in Ontario are certainly very good, the exclusion system in Ontario will need to be more far-reaching and likely more complicated than Sweden's system, which can rely more centrally on a single point of identification, the BankID. Ontario will not have such a simple focal point for client identification. Thus, out of necessity, it will need to develop a system that is smarter, in order to gather all the points of ID that could lead back to a given player's central profile for exclusion status and spend/time limit choices.

For example, what if an Ontarian in crisis, after having self-excluded via a gaming account attached to their normal home address and mobile number, then tries to register a gaming account with an alternate, but genuine postal address, telephone number and email address? What if the funding source for this new account is not in any way associated to their original, self-excluded player profile? Will that player have successfully exploited a loophole in the system, or will the system be robust enough to be able to connect the dots, and link this new account to their excluded profile and deny access as per their original, clear-eyed, sober wishes?

Sweden's BankID system makes self-exclusion workarounds far more difficult to achieve for players in crisis. Most of the goals set out by iGO in their RFP are relatively easy for the eventual solution developer to build and achieve, but a robust system that adjusts for this specific concern is what we see as the biggest hurdle in developing a truly successful central self-exclusion platform in Ontario, that works in a 'bullet-proof' manner within such a large, regulated market.

Ontario's coming centralized self-exclusion system is a huge reason that other provinces should follow their lead in the regulation of online gambling

Sweden did not launch their regulated market with their centralized self-exclusion system, neither will Ontario, but it is coming. In Sweden, at the time of writing, there were over 104,000 self-excluded players, which is almost exactly one per cent of their national population. If Ontario can develop a similarly intuitive and effective system that addresses the Know Your Customer issue mentioned above, we could eventually see approximately 158,000 self-excluded players in Ontario, which has a Q4 2023 population near 15.8 million.

Compare this to where we were prior to the passing of Bill C-218 and the opening of the regulated market. In a few short years, a group of people that is similar in number to all of those that live in the City of Barrie Ontario, will have been able to make themselves safer, and further away from gambling harms than ever before.

Despite such a significant and meaningful development on harm reduction for Ontario citizens, we hear no developments or interest from other provinces that might look to follow in Ontario's footsteps. Instead, the prospective provincial lottery corporations tout their own narrow and ineffectual self-exclusion programs, which only cover their respective lone official provincial online gaming brands, and perhaps their bricks and mortar gaming locations, leaving Canadians outside Ontario, in the 20+ year old "grey market" of offshore betting sites to fend for themselves.

What good is a self-exclusion program when it covers but one of the one hundred most visible online gambling options in any given province? The answer is: "No good at all, thank you very much."

If we assume that Sweden's self-exclusion rate of 1% could similarly apply to Canada, were regulated market conditions applied in all other provinces, approximately 250,000 Canadians outside Ontario could self-exclude from a huge swath of online gambling providers. In a quick, near frictionless manner, a quarter of a million Canadians could reduce the opportunity for both financial and health harms in a significant fashion. Yet all provincial governments and their subsidiary agencies stubbornly persist as if Ontario has not shown them the way forward, keeping their heads figuratively, but firmly in the sand.

Back to SNBET's Canadian sports betting news.