After Bill C-218: what's next in Canadian sports betting?

August 18, 2021

Having marketed reputable online sports betting providers to players in dozens of important national markets, many of which are strictly regulated, we at SNBET are keenly aware of the various successes and failures that have occurred around the world with regard to iGaming & sports betting regulation. As proud Canadians with this knowledge, we feel a duty to address the current issues and risks surrounding Canada's approach to the regulation of iGaming. Billions of dollars, and yes, even lives are at risk.

The passing of Bill C-218: a breakthrough, sort of

With the passing of Bill C-218 to allow single-event sports betting in Canada, the responsibility for gaming oversight now falls to the regulators in each Canadian province and territory. This will inevitably create several provincial, or in some cases regional iGaming markets across the country. In the world of bricks and mortar casinos, racetracks and bingo halls, this approach can work, since location matters. Things are different when we talk about online gambling or 'iGaming'.

In a world that is now more global than ever, where national borders have melted away in terms of the content we consume on YouTube, Instagram, Snapchat, TikTok, Twitch, Facebook and Twitter and where a large proportion of sporting broadcasts in Canada are beamed out nationally rather than provincially or regionally, the fact of the matter is that the regulation of iGaming is far better served through a national approach. As of now, this is not on the table given how Canada and its provinces currently oversee the regulation of gaming.

Where can Canada look for a precedent as a solution to this exact problem?

Look to another British Commonwealth colony: Australia, where their states & territories also regulate gaming. In the early 1990's, Australia allowed thousands of establishments across the country to house 'poker machines'. While successful in the taxes they drew, these nearly ubiquitous machines also spurred a huge gambling addiction crisis. 'Pokies' as they are known, created a very big problem for Australia and its government - then came the Internet.

In 1999, the Australian government recognized that online betting & gambling (iGaming) was different than gambling as they knew it. Going down to the local bar to gamble was one thing, but the Internet could bring endless gambling options directly into people's homes - something had to be done.

Thus the Australian state and territorial regulators were mandated to come together, eschewing their individually-defined bureaucratic responsibilities to create what is essentially a single iGaming market for sports betting, in order to better protect all of its citizens. Now, Australian consumers have a wide choice of legal and licensed providers that are available across the country, no matter which state or territory actually regulates the given betting site.

As a result of this, in Australia there is essentially no 'grey market' for online sports betting. This means that nearly all related gaming revenue is taxed and the vast majority of players across the country receive a cohesive approach to Responsible Gaming (RG) tools, support and messaging, both through the media and on the actual betting sites they use. Furthermore, as a result of this unified market, Australian sport has been able to maximise related partnership revenues. Let's look at this issue first and how it relates to Canada before delving into the big issue of RG.

|

|

| Map of Australia and its largest states & internal territories. Although each of these internal jurisdictions regulate gaming, the country as a whole is a single, unified market for online sports betting. |

How did a single, unified national iGaming market benefit Australian sport?

This unified market has allowed bookmaker brands to strike partnership deals with the top Australian sports leagues like the AFL and SportsBet (struck formally with BetEasy before being acquired), NRL with SportsBet and A-League with bet365. The AFL and NRL deals are reported to be worth about A$10 million annually.

The leagues' member clubs have also been able to strike their own partnerships as well, in order to fully maximise potential revenues. Two examples: In 2019 the NRL's Cronulla Sharks struck an agreement with PointsBet in order to rename their stadium, 'PointsBet Stadium' which is understood to be worth A$1.6million over four years. In the AFL, one of two 'Major Partners' for The Brisbane Lions Football Club is Aussie online bookmaker, 'Neds'.

Without a unified national marketplace, these substantial league and club marketing deals would not be possible. Why would a sports betting brand pay a significant fee as an official 'national' partner if it cannot actually serve the nation as a whole? Even the club partnerships are worth more within a unified market. While a betting brand might want to associate with a particular club and its fans, the bookmaker brand knows that fans across the country will be able to see their brand on the uniform or on stadium placements both live in-game, and on national highlight packages, and that all these fans are their potential customers. This is why advertising partnerships within a unified market are worth so much more than if the given betting brand was only able to be regulated for play in one or two of Australia's states or territories. Scale matters.

|

|

| The Cronulla Sharks of the NRL play at 'PointsBet Stadium'. |

|

|

| AFL's Brisbane Lions Training Jersey featuring Entain's Australian sportsbook 'Neds'. |

How will Canadian sport be affected by a provincial approach to iGaming regulation?

If as expected, Canada creates iGaming markets province-by-province, Canadian sports leagues and teams will suffer, especially if some provinces intend to pursue iGaming monopolies. Why would any betting company look to pay a significant sum for a national, league-wide marketing deal if they might only be able to serve players in Ontario? (Ontario has adopted an uncapped licensing approach.) How could clubs in BC or Quebec boost revenue from competitive marketing deals if the respective provincial governments are the only 'legal' providers in the market through their iGaming 'monopolies'?

This leads us back to the so-called 'grey-market' providers that can serve all of Canada - if not 'legally' so. In August 2021, even with the dawn of the post C-218 era on the horizon, the CFL struck a multi-year partnership with a young 'grey-market' sports betting brand known as 'BetRegal'. In the same month, the PGA of Canada also struck a 3-year deal with 'BetRegal'. In June 2021, the Canadian Premier League struck a marketing partnership with 'grey market' provider 'ComeOn!' If the provinces of Canada cannot come together to create a single legal market, Canadian sports properties like these will have a very difficult time in striking significant league marketing partnerships with 'legal' providers. If 'legal' providers cannot serve the whole country, why bother paying to market to the whole country?

Beyond this, striking marketing deals with 'legal' providers will also be difficult for many professional sports clubs. If Saskatchewan for example opens up to license its own iGaming marketplace participants like Ontario, how many providers will look to apply for a license in a market of just 1.2 million people? Answer: not nearly as many as compared to those that might wish to apply to serve Canada as a whole. This would leave very few potential marketing partners for a supremely successful CFL club like the Roughriders. A unified national market in Canada would give clubs in smaller provincial markets far more leverage to attract high values for these potential iGaming partnerships. Again, scale matters.

What did a single, unified market approach do for Responsible Gaming in Australia?

This single-market approach has also ensured that players across the country receive one cohesive message in terms or company marketing and Responsible Gaming (RG) communication for any associated player education, support and tools for safer gambling.

Australian RG mandates ensure that each online bookie only offers a sports betting vertical. Poker, casino, bingo and other games have been mandated to be stripped from .com.au site versions for their citizens, which are known for a high level of gambling addiction. Incentives such as new customer sports betting bonuses have also been banned in Australia. They are not allowed at all, be they on TV or for affiliate marketers on 'review sites'.

With a single, unified national market and plenty of legal, licensed options, sports bettors need not play in the 'grey market' to lay a wager in the manner they desire. The competition among legal providers ensures access to excellent betting platforms, competitive odds and a high level of customer service.

With the leverage of a single, 25 million-person market, Australia as a nation ensures that its cohesive RG mandates and messaging are the same for the 8 million-plus people in a large state like New South Wales, or for the 500,000+ people of Tasmania. Had states and territories regulated their iGaming markets individually, NSW likely would have had the power to mandate similar protections for its people, but smaller states and territories would not have been as successful.

Australia still faces its challenges with regard to gambling addiction, to be sure. However, by creating a single unified national market with a robust set of licensed providers, players can be satisfied playing within this 'legal' market and stay out of the 'grey' market. This at least ensures that players get direct access government-mandated tools like to proper account deposit limits, a complaints resolution service, the ability to take a 'time out', the ability to self-exclude, the ability to track one's budget & betting activity, and lastly, help in recognising if players are developing a problem. If Australia did not successfully stamp out the 'grey market' within its borders as it has, its people would always be at a far greater risk as compared to playing in a cohesive system that offers all of these protections.

What would happen to Responsible Gaming if Australia took a state & territory approach to online betting?

If the states and territories of Australia were not mandated to come together, there would be one set of online bookies and RG mandates and messaging for the 8 million people of New South Wales, another set of these for the 2.5 million of Western Australia, another set for the 6.5 million people of Victoria, and another set for the 5 million people of Queensland and so on and so on. One set of providers, RG messaging and mandates in each of Australia's six states and three internal territories.

How would this all have worked when Australians across the country settle in to watch a national broadcast of an Aussie Rules football match and see the gaming ads found in-venue, in-broadcast and during commercials? The result would be a lot of confusion with questions like: "Does that online bookie serve my state?" and "I feel like I need to gamble, but I want to self-exclude, where and how do I do this?"

Furthermore, without a single unified market, 'grey market' sports betting options would likely have been able to prey upon a checkerboard approach, absorbing players from the smaller jurisdictions that would no doubt have been poorly served in terms of officially-licensed and safer iGaming options.

Player confusion is exactly what will be created in Canada as a result of province-by-province regulation of iGaming

Given that Canada is looking to regulate online gaming province-by-province, the above example of confusion is exactly what we can expect for Canadian players across the country. How will this confusion manifest itself? Let us take the example of two provinces that seem to be diametrically opposed in their initial strategies for iGaming regulation:

1) British Columbia and the BCLC intend to continue operating under the PlayNow.com iGaming 'monopoly' only - no licensing scheme for new providers. They will attempt to be a one-provider market (at least to start).

2) Ontario through the AGCO and iGaming Ontario has taken an uncapped licensing approach, meaning that there will be no limit to the number of legal Ontario sports betting sites that may be allowed to operate.

Now, imagine a national CBC broadcast of Hockey Night in Canada: the Canucks are visiting the Maple Leafs. The boards around the ice at Scotiabank Arena in Toronto have several Ontario-licensed sports betting brands. The audience in BC will be seeing these ads. If in-broadcast intermission content becomes branded by Ontario-licensed gaming companies, the audience in BC will also see this marketing content. Furthermore, with the availability of several regional CBC channels, it is possible to watch the broadcast in BC from the Toronto CBC channel, meaning that gaming ads found during commercial breaks can also be consumed in BC.

All the people watching this game from BC will be seeing ads for these licensed Ontario betting sites, but they will not be able to play there. The ads however will trigger a desire to find a new betting site or perhaps even an incentive bonus offer - especially if they are dissatisfied with PlayNow.com, their one and only 'legal' provider.

This will lead many people to start Googling for the 'best BC betting sites' or 'top Canadian sportsbooks'. They will find a long list of websites that are designed to be found for these keyword strings and all related permutations. These affiliate marketing sites will refer these BC players to unlicensed, 'grey market' betting sites where BC players will not get the benefit of mandated RG tools & support and all gaming revenue will go untaxed.

Hence, the lack of a cohesive national approach to the regulation of online sports betting & iGaming is a bad idea. When you combine this approach with provincial iGaming 'monopolies', the situation becomes even more dangerous.

Gaming Monopolies, how they work or fail: the case of Quebec

If a society expects to have a free and open Internet, where individuals are not blocked from accessing certain websites, monopolies in iGaming simply do not work. The only way for an iGaming monopoly to actually function as a true monopoly would be if local Internet Service Providers were compelled to block the international 'grey market' iGaming providers within its given jurisdiction. Given the prevalence of Virtual Private Networks which can bypass such blocking, the given government would also need to work with local financial institutions to block payments to said 'grey' providers, halting the flow of money.

However, in 2018, the Quebec Government tried to implement a plan like this to block access to such 'grey market' iGaming providers, but the Quebec Supreme Court deemed the proposed law to be unconstitutional, which stopped the government from implementing the plan. Thus, consumers in Quebec have had access to nearly all the 'grey' providers that serve Canada.

Given the failure of this law, one might assume that a similar attempt to block money flows would also be defeated. In other words, the tools that must work alongside an iGaming monopoly, like the ones proposed by the BCLC (and maybe Loto-Quebec) are not and will not likely be lawful in Canada. This means that attempting an iGaming monopoly is a terrible idea that will fail, keeping the 'grey market' strong, which puts Canadians at risk and ensures gaming revenues will go untaxed. Beyond this, it will force a large proportion of Canadians to try to decipher the reputable 'grey market' betting sites from the betting sites to avoid - a task which is not easy given the amount of misinformation on the subject.

Do other jurisdictions take a monopolistic approach to iGaming and if so, what has been the result?

Norway likes to think they operate an iGaming monopoly and Norway's iGaming monopoly has failed miserably. There, they have done well to restrict many payment providers or e-wallets from processing payments to 'grey' iGaming providers, yet still the 'grey market' thrives in Norway. Just, go to almost any major 'international' online betting brand and you will find that they have invested in offering a 'Norsk' or Norwegian language version to serve this market. They also offer Norwegian Krone accounts so Norwegians can play in their native currency without converting funds.

While major e-wallet providers like Skrill, Neteller, PayPal and the like will not process payments or withdrawals to these betting sites for players in Norway, Mastercard and Visa payments are still widely available for use from Norway, along with other payment platforms. If Canadian provinces expect to pursue their own iGaming monopolies, expect the 'grey market' to continue to thrive therein, no matter what BCLC reports might try to say about player preferences for PlayNow.com.

What about iGaming regulation in the US? Can Canada learn from our neighbours to the South?

Yes. Canada can learn from the mistakes the US has made in iGaming regulation.

Once PASPA fell in 2018 in the US, it would of course be much easier for Canada to follow and make single-event betting legal, given how we share teams across so many pro sports leagues. Like Canada, the US approach to gaming regulation is done at the state level, which includes online gaming.

The US is a country that has even more national format broadcasts than Canada for the NFL, NBA, MLB, NHL and UFC among other properties. This fact exacerbates the problems of a state-by-state approach to iGaming, even more than it would in Canada. At the time of writing, about 115 million Americans or about one third of the US population live in states where online sports betting is not legally available within their state jurisdiction and won't be available any time soon. This includes California, Texas, Missouri, Minnesota, Utah and Georgia, among others.

What happens when people in these states tune in to watch any of the above national broadcasts and see countless ads and brand placements for 'licensed' official sports betting partners of all these leagues? They cannot play at these betting sites due to the patchwork, checkerboard approach to iGaming regulation. Yet, these ads create a desire to bet on sports online, which will inevitably lead these consumers to the US 'black market' (rather than Canada's 'grey market').

People will be moved to search online for things like 'California betting sites' or 'best US sportsbooks' and the like. The sites that they find in search results will refer them to 'black market' US providers like Bovada, 5Dimes, BetUS, MyBookie and BetOnline.ag among others that are based in Central America, which have no Responsible Gaming mandates whatsoever and remit no license fees or taxes. Again, that's 115 million Americans out of about 330 million, which have no legal online betting options, during a period many have noted as the US sports betting gold rush.

Despite millions and millions of dollars being spent by 'licensed' sportsbooks on marketing partnerships with leagues and broadcast networks, few if any additional resources have been set aside by state regulators to deal with the inevitable increase in problem gambling in these jurisdictions. NBC News outlines this problem as a ticking time bomb. This of course only pertains to the state markets where licensed betting providers face some level of oversight, to keep track of the problem. We cannot know exactly how bad things are for the one third of the US market that must still play at 'black market' providers, yet still face a bombardment of betting ads with each and every national broadcast of their favourite sporting events.

So when Canadian politicians and regulators think to themselves: 'Who should we follow in terms of iGaming regulation?', the USA is not the answer that should come to mind. Are we going to leave one third or perhaps even two thirds of Canadians to play in the 'grey market' also? That's what Canada is risking with its current patchwork, province-by-province approach.

|

|

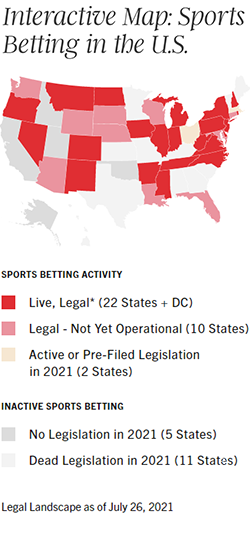

| The Interactive Map for Sports Betting regulation in the US as per the American Gaming Association. Does Canada really want to emulate this patchwork approach? |

In summary: What should happen & what will likely happen after C-218

What should be next for Canada after passing Bill C-218? The Government of Canada needs to recognize that iGaming requires its own special carve-out as a national issue to protect all of its citizens, just as the Government of Australia realized over twenty years ago. Online gambling or iGaming is just so different from land-based gambling. A patchwork, province-by-province approach to regulation puts Canadians at risk in so many ways.

What will likely happen? At the moment, with no such federal mandate, and deals to let the provinces regulate gaming, several Canadian provincial regulators appear bent on preserving their fiefdoms. As of yet there are no publically-known plans to work together across provinces to create a single unified market, with the exception of one hint out of Ontario. There, Attorney General Doug Downey has been quoted about the possibility for creating liquidity agreements with other provinces to allow for the legal movement of money across provincial borders.

If successful, this could lay the groundwork for at least some provincial markets to join the Ontario market through various partnerships, so that more Canadians could have access to a robust, legal iGaming market. However, given the fractured nature of provincial politics in Canada on issues like carbon taxes, pipelines and language among others, without a federal mandate, a fully unified national market is unlikely. There will always be some holdout provinces that think their way is best.

Rather than cede the responsibilities within their respective territories to work together for the greater good of Canadians, with blinders on, regulators are seemingly on a path that will ensure that the 'grey market' will continue to thrive. This will leave many Canadians without robust RG support, putting them at serious risk of harm, while allowing billions of gaming dollars to go untaxed annually, all as if C-218 never existed - but the regulators will be able to say that they did the job that was asked of them.

Sir Humphrey Appleby would have been so proud.

(The YouTube video is 15 seconds long.)

Related reading: